How to Apply for OPay POS Machine in Nigeria (2023 Step By Step Guide).

In Nigeria, the use of Point of Sale (POS) machines has become widespread in recent years, and for good reason. The convenience of using a POS machine cannot be overstated, both for business owners and customers. OPay, a leading fintech company in Nigeria, has taken it a step further with the introduction of the OPay POS machine.

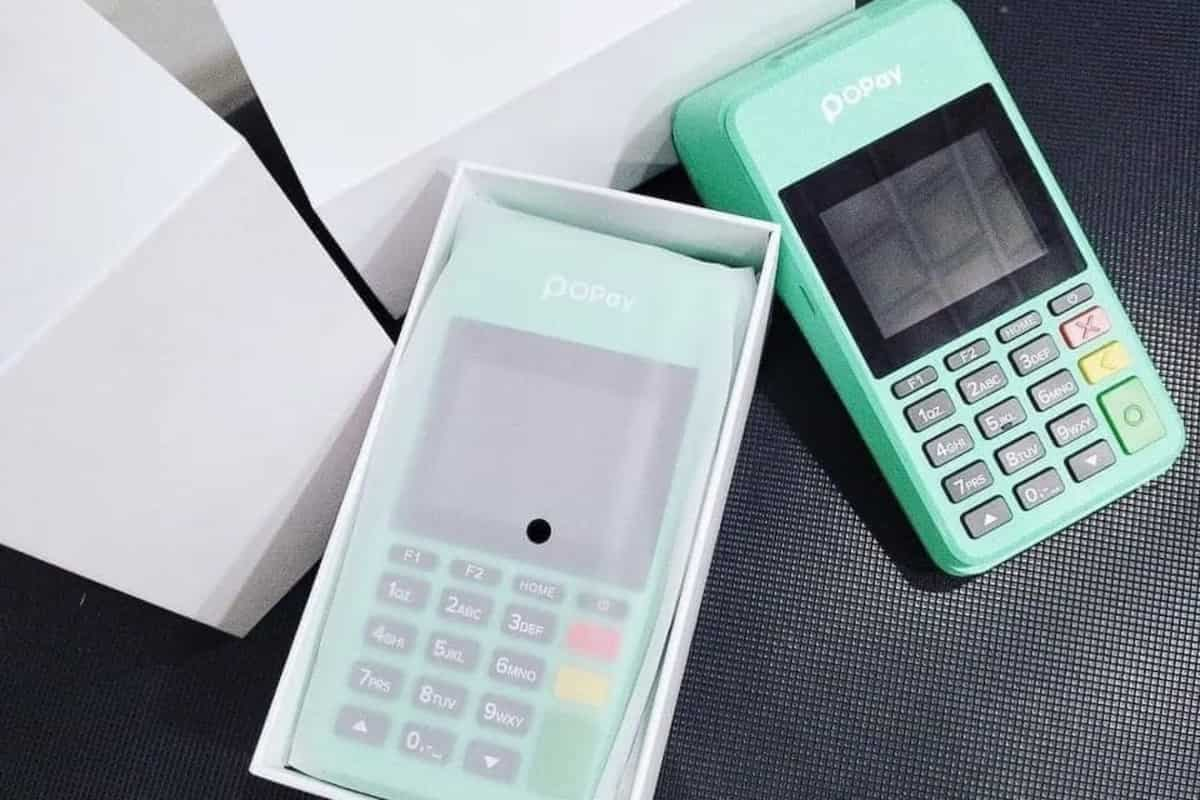

The OPay POS machine is a smart and efficient tool for any business owner looking to accept payments from customers using their ATM cards. The device comes with several features, including an easy-to-use interface, a long-lasting battery, and a sleek design.

How to apply for an OPay POS machine in Nigeria.

Step 1: Understand the OPay POS Machine

Before applying for an OPay POS machine, it is important to have a good understanding of what it is and how it works. The OPay POS machine is a handheld device that accepts payment from customers using their ATM cards.

The device comes with a printer that prints out receipts for customers after each transaction. The OPay POS machine is designed to work with all Nigerian ATM cards, including Visa, Mastercard, and Verve.

Step 2: Meet the Requirements

To apply for an OPay POS machine, you must meet the following requirements:

- A valid means of identification (National ID, Driver’s License, International Passport)

- A registered business name with CAC (for business owners)

- A functional current account with any Nigerian bank

Step 3: Choose Your Preferred OPay POS Machine

OPay offers different types of POS machines to suit different business needs. There are currently two types of OPay POS machines available in Nigeria: the OPay Smart POS and the OPay Terminal.

The OPay Smart POS is a handheld device that accepts payments from customers using their ATM cards. It comes with a 4G network connection, a long-lasting battery, and a printer for printing out receipts.

The OPay Terminal, on the other hand, is a countertop device that accepts payments using QR codes. It is ideal for businesses that do not require mobility.

Step 4: Apply for the OPay POS Machine

Once you have met the requirements and chosen your preferred OPay POS machine, the next step is to apply for it. To apply for an OPay POS machine, follow these steps:

- Visit the OPay website or download the OPay app on your mobile phone.

- Sign up for an OPay account or log in if you already have one.

- Click on the “OPay POS” option on the app or website.

- Select your preferred POS machine and fill out the application form.

- Upload the necessary documents (means of identification, business registration certificate, and bank statement).

- Wait for approval from OPay.

Step 5: Receive Your OPay POS Machine

After your application has been approved, you will receive your OPay POS machine within a few days. The device comes with a user manual that explains how to set it up and use it. Once you have received your device, follow these steps to set it up:

- Charge the device using the provided charger.

- Turn on the device by pressing and holding the power button.

- Follow the instructions on the screen to connect the device to the internet.

- Test the device by making a test transaction.

Opay Smart POS

The OPay Smart POS is the latest addition to the OPay POS device family. It is an advanced and innovative point-of-sale device that is designed to offer faster and more efficient transactions to merchants and customers. The OPay Smart POS device comes with several features that make it stand out from other POS machines in the market.

Features of OPay Smart POS

1. Faster Transactions:

The OPay Smart POS device is designed to process transactions faster than other POS machines. This means that customers can complete their transactions in seconds, thereby reducing queues and wait times.

2. Large Touchscreen Display:

The OPay Smart POS device comes with a large touchscreen display that makes it easy for customers to navigate and complete transactions. The display is also bright and clear, making it easy to read even in bright sunlight.

3. Built-in Printer:

The OPay Smart POS device comes with a built-in printer that enables merchants to print receipts for customers. This eliminates the need for a separate printer, saving space and reducing costs.

4. Multiple Payment Options:

The OPay Smart POS device supports multiple payment options, including debit and credit cards, QR codes, and OPay wallets. This makes it easy for customers to pay using their preferred payment method.

5. Long Battery Life:

The OPay Smart POS device comes with a long battery life that can last up to 72 hours on standby mode. This means that merchants can use the device for several days without the need for frequent recharging.

Opay Terminal

OPay Terminal is a digital payment solution that enables merchants to accept payments from customers using their ATM cards. The terminal is a portable device that can be used both indoors and outdoors, making it an ideal payment solution for businesses that require mobility.

Benefits of Using OPay Terminal

1.Increased Mobility:

The OPay Terminal is a portable device that can be used both indoors and outdoors, making it an ideal payment solution for businesses that require mobility.

2. Multiple Payment Options:

The OPay Terminal supports multiple payment options, making it easy for customers to pay using their preferred payment method.

3. Increased Security:

The OPay Terminal comes with several security features, including a PIN pad, encryption technology, and a tamper-proof design. This ensures that transactions are secure and protected from fraud.

4. Cost-effective:

The OPay Terminal eliminates the need for a separate printer, saving space and reducing costs. The long battery life also reduces the need for frequent recharging.

5. Improved Customer Experience:

The OPay Terminal comes with a large display that makes it easy for customers to read the transaction details and complete their transactions. This improves the overall customer experience and increases customer satisfaction

Opay POS Machine price

The price of the OPay Smart POS is around N65,000. This device is a bit more expensive than some other POS machines on the market, but it offers several features that make it worth the cost.

The price of the OPay Terminal Plus is around N70,000. This device is also more expensive than some other POS machines on the market, but it offers several features that make it a great investment for merchants.

OPay also offers a standard POS machine that is more affordable than the Smart POS and Terminal Plus. This device is a simple and compact payment solution that allows merchants to accept debit and credit card payments. The price of the standard OPay POS machine is around N30,000.

It’s important to note that the price of an OPay POS machine may vary depending on where you purchase it from. Some authorized OPay agents may offer promotions or discounts on the device, so it’s a good idea to shop around and compare prices before making a purchase.

In addition to the cost of the device, there may be other fees associated with using an OPay POS machine. For example, there may be transaction fees, maintenance fees, or other charges that vary depending on the type of device you have and the services you use. It’s important to understand all of the costs associated with using an OPay POS machine before making a purchase.

OPay POS Agent

OPay also offers opportunities for individuals to become OPay POS agents. An OPay POS agent is someone who provides financial services to customers using OPay products, including the OPay POS machine. As an agent, you will earn commissions on each transaction made using the POS machine. To become an OPay POS agent, follow these steps:

Step 1: Meet the Requirements

To become an OPay POS agent, you must meet the following requirements:

- A valid means of identification (National ID, Driver’s License, International Passport)

- A functional current account with any Nigerian bank

- A business location or shop

Step 2: Apply to Become an OPay POS Agent

To apply to become an OPay POS agent, follow these steps:

- Visit the OPay website or download the OPay app on your mobile phone.

- Sign up for an OPay account or log in if you already have one.

- Click on the “Become an Agent” option on the app or website.

- Fill out the application form.

- Wait for approval from OPay.

Step 3: Receive Your OPay POS Machine

Once your application has been approved, you will receive your OPay POS machine within a few days. The device comes with a user manual that explains how to set it up and use it. Once you have received your device, follow the steps outlined in the “Receive Your OPay POS Machine” section above to set it up.

Step 4: Provide Financial Services to Customers

As an OPay POS agent, you will provide financial services to customers using the OPay POS machine. These services include cash withdrawal, cash deposit, bill payments, airtime top-up, and money transfer. You will earn commissions on each transaction made using the POS machine.

OPay POS Business

The OPay POS machine offers a great opportunity for entrepreneurs to start a profitable business in Nigeria. By becoming an OPay POS agent or using the device in your business, you can provide financial services to customers and earn commissions on each transaction. To start an OPay POS business, follow these steps:

Step 1: Choose a Business Location

The first step in starting an OPay POS business is to choose a suitable location. Look for areas with high foot traffic, such as markets, shopping malls, or busy streets.

Step 2: Register Your Business

Register your business with the Corporate Affairs Commission (CAC) and obtain all the necessary licenses and permits required to operate a financial services business in Nigeria.

Step 3: Apply for an OPay POS Machine

Apply for an OPay POS machine by following the steps outlined in the “Apply for the OPay POS Machine” section above. Choose the type of POS machine that is most suitable for your business needs.

Step 4: Set Up Your OPay POS Machine

Once you have received your OPay POS machine, follow the steps outlined in the “Receive Your OPay POS Machine” section above to set it up.

Step 5: Provide Financial Services to Customers

Provide financial services to customers using the OPay POS machine. These services include cash withdrawal, cash deposit, bill payments, airtime top-up, and money transfer. Earn commissions on each transaction made using the POS machine.

FAQs

What is OPay POS machine?

OPay POS machine is a digital payment solution that enables merchants to accept payments from customers using their ATM cards or OPay wallets.

How do I apply for an OPay POS machine?

To apply for an OPay POS machine, you need to register as an OPay agent by visiting the OPay website or downloading the OPay app on your mobile phone. Fill out the agent application form and wait for approval from OPay. Once your application has been approved, you can purchase an OPay POS machine from an authorized OPay agent.

How much does an OPay POS machine cost?

The price of an OPay POS machine varies depending on the type of device you want. The new OPay Smart POS costs around N65,000, while the OPay Terminal Plus costs around N70,000.

Can I use an OPay POS machine without being an OPay agent?

No, you cannot use an OPay POS machine without being an OPay agent. To use an OPay POS machine, you need to register as an OPay agent and purchase the device from an authorized OPay agent.

What payment options are available on OPay POS machines?

OPay POS machines support multiple payment options, including debit and credit cards, QR codes, and OPay wallets.

How do I get an OPay Terminal?

To get an OPay Terminal, you need to register as an OPay agent, fill out the agent application form, and wait for approval from OPay. Once your application has been approved, you can purchase an OPay Terminal from an authorized OPay agent.

What is the price of an OPay Terminal?

The price of an OPay Terminal varies depending on the type of device you want. The standard OPay Terminal costs around N40,000, while the OPay Terminal Plus costs around N70,000.

What are the benefits of using OPay POS and Terminal?

The benefits of using OPay POS and Terminal include increased mobility, multiple payment options, increased security, cost-effectiveness, and impro

How can I troubleshoot issues with my OPay POS machine or Terminal?

If you are experiencing issues with your OPay POS machine or Terminal, you can contact OPay customer support for assistance. They will guide you through the troubleshooting process and help you resolve any issues.

Conclusion

The OPay POS machine is a smart and efficient tool for any business owner looking to accept payments from customers using their ATM cards. It offers a great opportunity for entrepreneurs to start a profitable business in Nigeria by becoming an OPay POS agent or using the device in their business.

By following the step-by-step guide outlined in this article, you can easily apply for an OPay POS machine and start providing financial services to customers.